How To Record A Discount In Accounting . As it is a reduction in sales, sales discounts are recorded on the. An example of a sales discount is. Recording sales discounts accurately in the accounting books is fundamental for maintaining precise financial. Sales discount accounting is straightforward. How to account for sales discounts. A sales discount is a reduction taken by a customer from the invoiced price of goods or services, in exchange for early payment to the. Hence, saving 2% over a 20 days period represents a 36.5% (2% x 365 days / 20 days) of effective annual rate. When a business sells goods on credit to a customer the terms will stipulate the date on which the amount outstanding is to be paid. Sales or cash discounts are. Trade discounts are not recorded as sales discounts and deduct directly at the time recording sales.

from business-accounting.net

Hence, saving 2% over a 20 days period represents a 36.5% (2% x 365 days / 20 days) of effective annual rate. Trade discounts are not recorded as sales discounts and deduct directly at the time recording sales. Recording sales discounts accurately in the accounting books is fundamental for maintaining precise financial. As it is a reduction in sales, sales discounts are recorded on the. A sales discount is a reduction taken by a customer from the invoiced price of goods or services, in exchange for early payment to the. Sales discount accounting is straightforward. An example of a sales discount is. When a business sells goods on credit to a customer the terms will stipulate the date on which the amount outstanding is to be paid. How to account for sales discounts. Sales or cash discounts are.

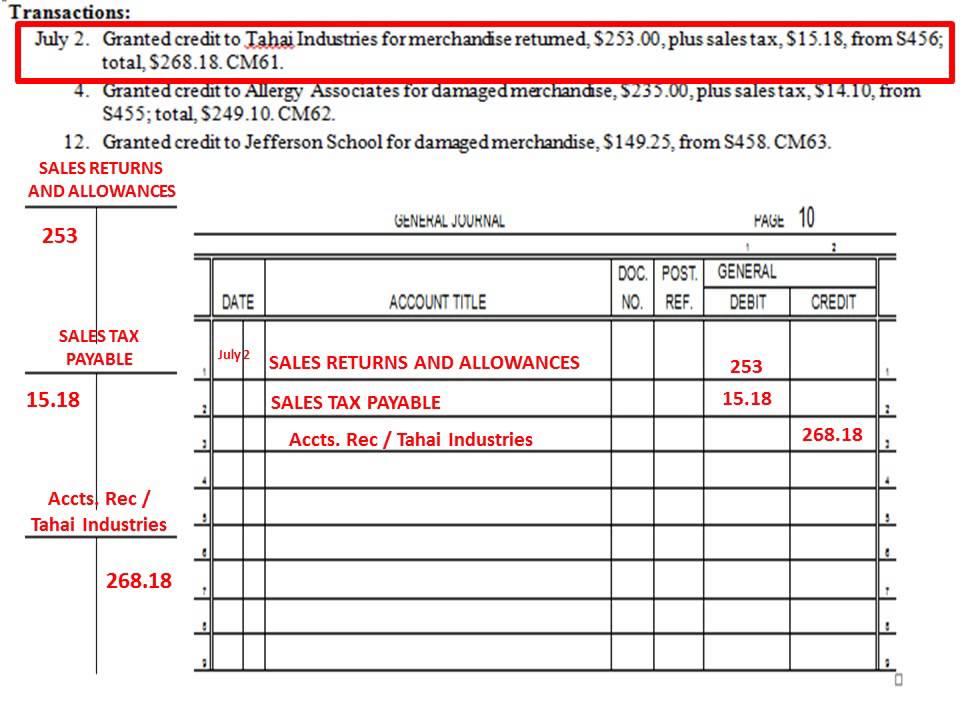

How to Record a Sales Return for Accounting Business Accounting

How To Record A Discount In Accounting Recording sales discounts accurately in the accounting books is fundamental for maintaining precise financial. Sales or cash discounts are. Recording sales discounts accurately in the accounting books is fundamental for maintaining precise financial. As it is a reduction in sales, sales discounts are recorded on the. When a business sells goods on credit to a customer the terms will stipulate the date on which the amount outstanding is to be paid. An example of a sales discount is. A sales discount is a reduction taken by a customer from the invoiced price of goods or services, in exchange for early payment to the. How to account for sales discounts. Sales discount accounting is straightforward. Hence, saving 2% over a 20 days period represents a 36.5% (2% x 365 days / 20 days) of effective annual rate. Trade discounts are not recorded as sales discounts and deduct directly at the time recording sales.

From www.teachoo.com

Entries for Sales and Purchase in GST Accounting Entries in GST How To Record A Discount In Accounting Trade discounts are not recorded as sales discounts and deduct directly at the time recording sales. How to account for sales discounts. Hence, saving 2% over a 20 days period represents a 36.5% (2% x 365 days / 20 days) of effective annual rate. As it is a reduction in sales, sales discounts are recorded on the. When a business. How To Record A Discount In Accounting.

From www.youtube.com

Accounting for a Long Term Note Payable YouTube How To Record A Discount In Accounting Recording sales discounts accurately in the accounting books is fundamental for maintaining precise financial. Sales or cash discounts are. Trade discounts are not recorded as sales discounts and deduct directly at the time recording sales. A sales discount is a reduction taken by a customer from the invoiced price of goods or services, in exchange for early payment to the.. How To Record A Discount In Accounting.

From www.slideserve.com

PPT Chapter 5 PowerPoint Presentation, free download ID6095373 How To Record A Discount In Accounting A sales discount is a reduction taken by a customer from the invoiced price of goods or services, in exchange for early payment to the. How to account for sales discounts. Recording sales discounts accurately in the accounting books is fundamental for maintaining precise financial. When a business sells goods on credit to a customer the terms will stipulate the. How To Record A Discount In Accounting.

From biz.libretexts.org

9.1 Explain the Revenue Recognition Principle and How It Relates to How To Record A Discount In Accounting When a business sells goods on credit to a customer the terms will stipulate the date on which the amount outstanding is to be paid. How to account for sales discounts. Sales discount accounting is straightforward. Recording sales discounts accurately in the accounting books is fundamental for maintaining precise financial. A sales discount is a reduction taken by a customer. How To Record A Discount In Accounting.

From www.transtutors.com

(Solved) Exercise 811 (Algo) Trade and purchase discounts; the gross How To Record A Discount In Accounting Hence, saving 2% over a 20 days period represents a 36.5% (2% x 365 days / 20 days) of effective annual rate. Sales or cash discounts are. Recording sales discounts accurately in the accounting books is fundamental for maintaining precise financial. How to account for sales discounts. When a business sells goods on credit to a customer the terms will. How To Record A Discount In Accounting.

From business-accounting.net

How to Record a Sales Return for Accounting Business Accounting How To Record A Discount In Accounting As it is a reduction in sales, sales discounts are recorded on the. Hence, saving 2% over a 20 days period represents a 36.5% (2% x 365 days / 20 days) of effective annual rate. Sales or cash discounts are. Trade discounts are not recorded as sales discounts and deduct directly at the time recording sales. Recording sales discounts accurately. How To Record A Discount In Accounting.

From www.principlesofaccounting.com

Purchases With Discount (gross) How To Record A Discount In Accounting A sales discount is a reduction taken by a customer from the invoiced price of goods or services, in exchange for early payment to the. Sales or cash discounts are. Sales discount accounting is straightforward. As it is a reduction in sales, sales discounts are recorded on the. How to account for sales discounts. Recording sales discounts accurately in the. How To Record A Discount In Accounting.

From unbrick.id

How To Calculate Trade Discount How To Record A Discount In Accounting Hence, saving 2% over a 20 days period represents a 36.5% (2% x 365 days / 20 days) of effective annual rate. A sales discount is a reduction taken by a customer from the invoiced price of goods or services, in exchange for early payment to the. As it is a reduction in sales, sales discounts are recorded on the.. How To Record A Discount In Accounting.

From www.youtube.com

Gross Method vs. Net Method (Recording Journal Entries for Sales) YouTube How To Record A Discount In Accounting Trade discounts are not recorded as sales discounts and deduct directly at the time recording sales. Recording sales discounts accurately in the accounting books is fundamental for maintaining precise financial. Hence, saving 2% over a 20 days period represents a 36.5% (2% x 365 days / 20 days) of effective annual rate. How to account for sales discounts. Sales or. How To Record A Discount In Accounting.

From www.slideserve.com

PPT Cash, Shortterm Investments and Accounts Receivable PowerPoint How To Record A Discount In Accounting Sales discount accounting is straightforward. How to account for sales discounts. As it is a reduction in sales, sales discounts are recorded on the. An example of a sales discount is. Recording sales discounts accurately in the accounting books is fundamental for maintaining precise financial. Hence, saving 2% over a 20 days period represents a 36.5% (2% x 365 days. How To Record A Discount In Accounting.

From www.double-entry-bookkeeping.com

Purchase Discount in Accounting Double Entry Bookkeeping How To Record A Discount In Accounting Sales discount accounting is straightforward. When a business sells goods on credit to a customer the terms will stipulate the date on which the amount outstanding is to be paid. Hence, saving 2% over a 20 days period represents a 36.5% (2% x 365 days / 20 days) of effective annual rate. How to account for sales discounts. Trade discounts. How To Record A Discount In Accounting.

From spscc.pressbooks.pub

LO 6.4a Analyze and Record Transactions for the Sale of Merchandise How To Record A Discount In Accounting When a business sells goods on credit to a customer the terms will stipulate the date on which the amount outstanding is to be paid. Sales or cash discounts are. An example of a sales discount is. How to account for sales discounts. Hence, saving 2% over a 20 days period represents a 36.5% (2% x 365 days / 20. How To Record A Discount In Accounting.

From haipernews.com

How To Calculate Discount Received In Accounting Haiper How To Record A Discount In Accounting How to account for sales discounts. As it is a reduction in sales, sales discounts are recorded on the. When a business sells goods on credit to a customer the terms will stipulate the date on which the amount outstanding is to be paid. Sales or cash discounts are. Hence, saving 2% over a 20 days period represents a 36.5%. How To Record A Discount In Accounting.

From souravpupu.blogspot.com

Oracle APPS (Oracle Application EBUSINESS SUITE) 11i R12 Fusion How To Record A Discount In Accounting Sales discount accounting is straightforward. A sales discount is a reduction taken by a customer from the invoiced price of goods or services, in exchange for early payment to the. How to account for sales discounts. When a business sells goods on credit to a customer the terms will stipulate the date on which the amount outstanding is to be. How To Record A Discount In Accounting.

From jennifercgreenxo.blob.core.windows.net

Journal Entries For Cost Of Goods Sold How To Record A Discount In Accounting As it is a reduction in sales, sales discounts are recorded on the. How to account for sales discounts. Recording sales discounts accurately in the accounting books is fundamental for maintaining precise financial. A sales discount is a reduction taken by a customer from the invoiced price of goods or services, in exchange for early payment to the. Sales or. How To Record A Discount In Accounting.

From simpleinvoice17.net

Off Invoice Discount Invoice Template Ideas How To Record A Discount In Accounting A sales discount is a reduction taken by a customer from the invoiced price of goods or services, in exchange for early payment to the. How to account for sales discounts. Trade discounts are not recorded as sales discounts and deduct directly at the time recording sales. Recording sales discounts accurately in the accounting books is fundamental for maintaining precise. How To Record A Discount In Accounting.

From www.slideserve.com

PPT Accounting for Merchandising Business PowerPoint Presentation How To Record A Discount In Accounting How to account for sales discounts. As it is a reduction in sales, sales discounts are recorded on the. Hence, saving 2% over a 20 days period represents a 36.5% (2% x 365 days / 20 days) of effective annual rate. Recording sales discounts accurately in the accounting books is fundamental for maintaining precise financial. An example of a sales. How To Record A Discount In Accounting.

From www.double-entry-bookkeeping.com

Chain Discounts in Accounting Double Entry Bookkeeping How To Record A Discount In Accounting An example of a sales discount is. Trade discounts are not recorded as sales discounts and deduct directly at the time recording sales. When a business sells goods on credit to a customer the terms will stipulate the date on which the amount outstanding is to be paid. How to account for sales discounts. Sales or cash discounts are. Recording. How To Record A Discount In Accounting.